EURJPY=X Technical Analysis July 22, 2025 | RSI, SMA & MACD Outlook

Key Indicators

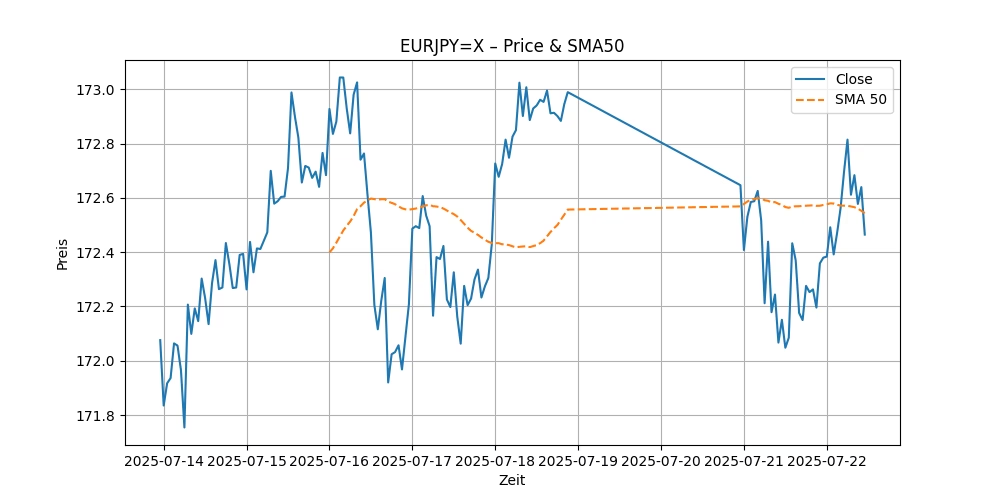

Close: 172.46499633789062 | RSI(14): 59.36 | SMA(50): 172.54 | MACD: 0.0527

Chart Overview

Market Outlook

Title: In-depth Technical Analysis and Price Prediction for EURJPY=X as of July 22, 2025

The EURJPY=X, a popular currency pair representing the exchange rate between the Euro and the Japanese Yen, has shown some interesting movements as of July 22, 2025. In this analysis, we will delve into the technical indicators and price movements to provide a comprehensive EURJPY=X stock forecast, focusing on whether the currency pair might be entering overbought conditions and what investors might expect in the near future.

Current Market Position

As of July 22, 2025, EURJPY=X closed at 172.46499633789062. This figure is crucial as it represents a significant data point for traders and investors analyzing the currency pair’s performance. The closing price is a snapshot of where the market settled at the end of the trading day, which is used as a benchmark to gauge the currency pair’s strength or weakness.

Technical Indicators Analysis

1. Relative Strength Index (RSI)

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements on a scale from 0 to 100. Typically, an RSI above 70 indicates that a security is overbought, while an RSI below 30 suggests that it is oversold. The RSI for EURJPY=X stands at 59.36. This indicates that the currency pair is neither overbought nor oversold, suggesting a relatively balanced market with no immediate extreme conditions that would prompt a rapid sell-off or buying spree.

2. Simple Moving Average (SMA)

The Simple Moving Average (SMA) is a calculation that takes the arithmetic mean of a given set of prices over a specific number of days in the past, and it is used to smooth out price data to identify the trend direction. The 50-day SMA for EURJPY=X is at 172.54. Since the current price is slightly below the SMA, this suggests a potential bearish (downward) trend on a very short-term basis. However, the proximity of the price to the SMA also indicates that the price is relatively stable.

3. Moving Average Convergence Divergence (MACD)

The Moving Average Convergence Divergence (MACD) is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. The MACD for EURJPY=X is 0.0527, with a signal line of 0.0334. The MACD line exceeding the signal line typically suggests a bullish (upward) buying opportunity, indicating that the currency pair might experience upward momentum in the near term.

EURJPY=X Price Prediction and Forecast

Considering the current readings from the RSI, SMA, and MACD, the EURJPY=X appears to be in a stable condition with a slight inclination towards bullish behavior in the short term. The MACD indicates a potential increase in buying activity, which could drive the price up if sustained. However, the proximity of the price to the 50-day SMA suggests that any upward movement might be gradual and not abrupt.

Potential Overbought Conditions

While the current RSI does not indicate overbought conditions, it is crucial for traders and investors to monitor this indicator closely. An RSI approaching 70 would suggest that the currency pair might be getting overvalued, which could lead to a price correction. As of now, the market does not show immediate signs of overbought conditions, but vigilance is necessary as currency markets can be volatile.

The EURJPY=X stock forecast as of July 22, 2025, suggests a stable yet cautiously optimistic outlook. The technical analysis indicates no immediate signs of overbought conditions, and the slight bullish signal from the MACD could mean potential gains for investors who enter at current levels. However, the close proximity of the price to its 50-day SMA and a moderate RSI calls for careful monitoring of the pair for any signs of significant price corrections or confirmations of an upward trend.

Investors and traders should consider these technical indicators as part of a broader analysis, including geopolitical events, economic data releases, and market sentiment, to make informed decisions about trading or investing in the EURJPY=X currency pair. As always, diversification and risk management are key strategies in the volatile realm of forex trading.