EURUSD=X Technical Analysis July 22, 2025 | RSI, SMA & MACD Outlook

Key Indicators

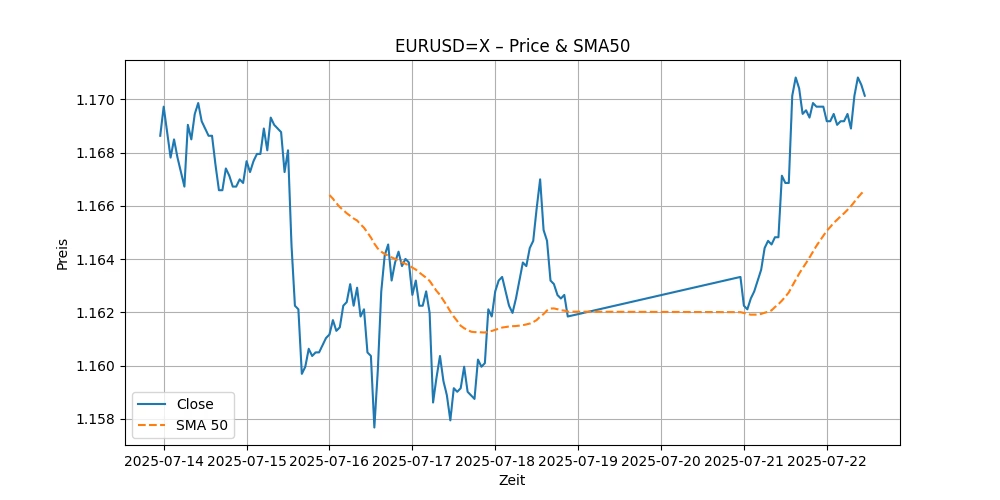

Close: 1.1701380014419556 | RSI(14): 54.29 | SMA(50): 1.17 | MACD: 0.0010

Chart Overview

Market Outlook

Title: In-Depth Technical Analysis and Price Prediction for EURUSD=X as of July 22, 2025

The EURUSD=X, representing the exchange rate between the Euro and the US Dollar, is a crucial financial metric for traders and investors worldwide. As of July 22, 2025, the EURUSD=X closed at 1.1701380014419556. This article provides a detailed technical analysis of EURUSD=X, focusing on key indicators such as the Relative Strength Index (RSI), Simple Moving Average (SMA), and the Moving Average Convergence Divergence (MACD). We will also explore the EURUSD=X price prediction and stock forecast, incorporating an analysis of current overbought or oversold conditions.

Understanding the Current Price and Its Implications

The closing price of EURUSD=X at 1.1701380014419556 indicates the current exchange rate at which one Euro can be exchanged for US dollars. This rate is pivotal for forex traders and businesses involved in international trade. The exchange rate is influenced by multiple factors including economic indicators, central bank policies, and market sentiment.

Technical Indicators Breakdown

1. Relative Strength Index (RSI)

The RSI is a momentum oscillator used to measure the speed and change of price movements. It ranges from 0 to 100 and is typically used to identify overbought or oversold conditions in a trading instrument. An RSI above 70 is considered overbought, while an RSI below 30 is considered oversold. As of July 22, 2025, the RSI for EURUSD=X stands at 54.29. This suggests that the currency pair is neither overbought nor oversold, indicating a relatively balanced market condition. Traders might interpret this as a stable market without immediate extreme pressures on price movements.

2. Simple Moving Average (SMA)

The SMA is an arithmetic moving average calculated by adding recent closing prices and then dividing that by the number of time periods in the calculation average. For EURUSD=X, the 50-day SMA is at 1.17, exactly matching the closing price. This alignment suggests that the market is in equilibrium, with the current price being typical of recent trading periods. A SMA that aligns closely with the current price often indicates a potential turning point or support level, where the price might either bounce back or break through.

3. Moving Average Convergence Divergence (MACD)

The MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. The MACD for EURUSD=X is 0.0010, with a signal line of 0.0011. Since the MACD is slightly below the signal line, it suggests a bearish signal, indicating that the EURUSD=X might see a decrease in price in the near term. However, the closeness of these values also points to a weak bearish signal, which might not be strong enough to suggest a significant downtrend.

EURUSD=X Price Prediction and Stock Forecast

Based on the analysis of the technical indicators, the EURUSD=X stock forecast appears to be leaning slightly towards a bearish sentiment in the short term, given the MACD position below its signal line. However, the overall market condition, as suggested by the RSI and the alignment of the SMA with the current price, shows no extreme volatility or pressure. Therefore, any downward movement in price might be mild and short-lived.

Investors and traders should watch for potential fluctuations around the SMA level of 1.17, which could act as a psychological support or resistance level in the coming days. If the price maintains above this SMA, it could indicate bullish sentiment building up, potentially leading to an upward price movement. Conversely, a consistent price drop below the SMA could confirm the bearish trend suggested by the MACD.

The technical analysis of EURUSD=X as of July 22, 2025, indicates a market in balance with a slight inclination towards bearish conditions. Traders should monitor key levels around the SMA and watch for any significant deviations in the RSI and MACD readings for more robust trading signals. As always, it is crucial to consider broader economic conditions and news that could impact market sentiment and cause sudden changes in the currency pair’s dynamics.