ETH-USD Technical Analysis July 23, 2025 | RSI, SMA & MACD Outlook

Key Indicators

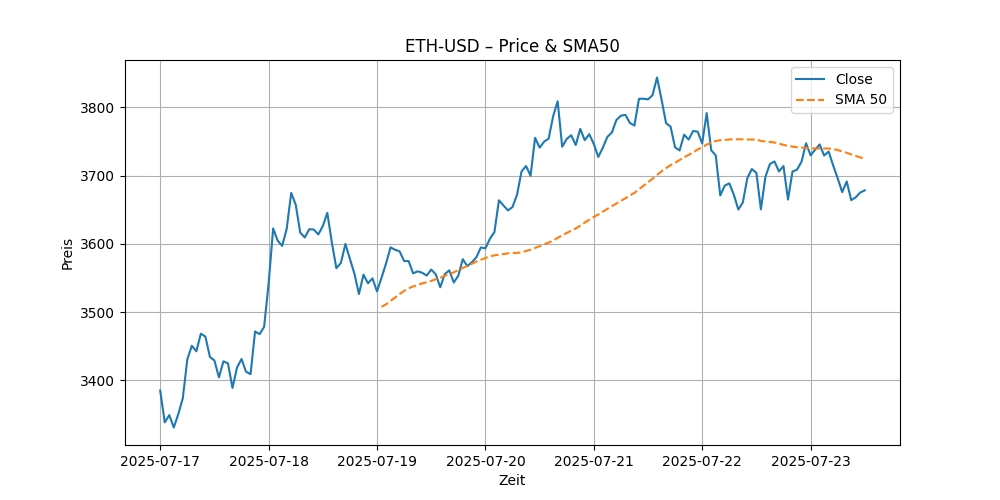

Close: 3678.408447265625 | RSI(14): 39.48 | SMA(50): 3724.16 | MACD: -11.4528

Chart Overview

Market Outlook

As of July 23, 2025, the Ethereum to USD exchange rate (ETH-USD) presents a complex picture that warrants a detailed technical analysis. This analysis aims to provide insights into the ETH-USD price prediction and ETH-USD stock forecast, focusing on key technical indicators and market conditions. Understanding these technical terms and their implications will help both seasoned traders and newcomers navigate the intricacies of cryptocurrency trading.

Previous Day’s Analysis Recap

According to the analysis on July 22, 2025, provided by lissadiurnum.com, Ethereum showed specific trends indicated by popular technical indicators such as the Relative Strength Index (RSI), the Simple Moving Average (SMA), and the Moving Average Convergence Divergence (MACD). These indicators are essential tools for traders to gauge market sentiment, trend direction, and potential reversal points.

Current Price and Moving Averages

As of today, ETH-USD closed at $3678.408, which is slightly below its 50-day SMA of $3724.16. The SMA is a technical indicator that helps smooth out price data by creating a constantly updated average price. In this case, the 50-day SMA gives us an idea of the medium-term trend, suggesting that ETH is currently experiencing a slight downtrend as the price is below the average of the past 50 days.

Relative Strength Index (RSI)

The RSI, which stands at 39.48, is a momentum oscillator that measures the speed and change of price movements. It typically moves between 0 and 100 and is considered overbought when above 70 and oversold when below 30. An RSI near 40 indicates that Ethereum is neither in the overbought nor oversold territory, but it leans towards a bearish sentiment as it is closer to the oversold threshold.

Moving Average Convergence Divergence (MACD)

The MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. The MACD for ETH-USD is currently at -11.4528, with a signal line of -6.9855. The negative values indicate bearish momentum, and the fact that the MACD is below the signal line reinforces this bearish outlook. This divergence suggests that the downward momentum in ETH price is strong, and there might be continued bearish pressure in the near term.

Market Sentiment and Technical Outlook

Combining these indicators, the technical outlook for ETH-USD appears slightly bearish. The price being below the 50-day SMA and the MACD’s position below its signal line both support this view. However, the RSI near 40 suggests that while the momentum is bearish, it might not be strong enough to push the cryptocurrency into a deeply oversold condition, which sometimes precedes a price rebound.

ETH-USD Price Prediction and Forecast

Looking ahead, the ETH-USD stock forecast could be influenced by several factors including broader market trends, investor sentiment, and upcoming technological developments in the Ethereum network such as upgrades or regulatory news. If the bearish momentum continues and ETH remains below its 50-day SMA, we might see further declines. However, if Ethereum can regain strength and push above its SMA and the RSI moves towards a more neutral or bullish zone above 50, the outlook could turn bullish.

Potential Overbought Conditions to Watch

While current indicators do not show overbought conditions, traders should remain vigilant. An overbought condition occurs when an asset is believed to be traded at a level above its intrinsic or true value, leading to a price correction. If Ethereum’s RSI were to rise above 70, it would be an alert for possible overbought conditions, potentially leading to a price pullback.

In conclusion, the ETH-USD pair as of July 23, 2025, shows a bearish trend with potential for further declines unless key technical levels are breached to the upside. Investors and traders should keep an eye on these technical indicators and market developments to make informed decisions. As always, it’s advisable to use a combination of technical analysis, fundamental insights, and current market news when planning your investment strategy in the volatile cryptocurrency market.