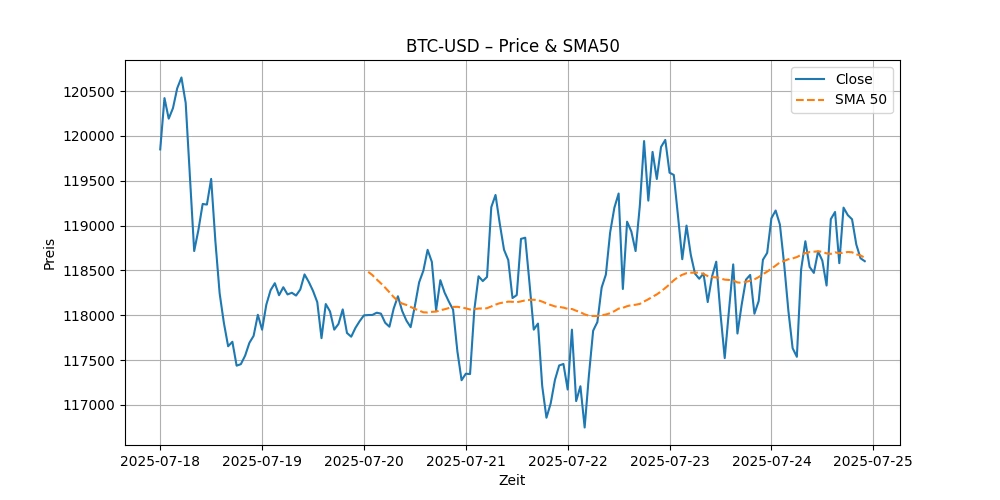

BTC-USD Technical Analysis July 25, 2025 | RSI, SMA & MACD Outlook

Key Indicators

Close: 118602.828125 | RSI(14): 46.90 | SMA(50): 118642.08 | MACD: 87.4666

Chart Overview

Market Outlook

As of July 25, 2025, the Bitcoin to US Dollar (BTC-USD) exchange rate has shown a closing price of 118602.828125. This article provides an in-depth technical analysis of BTC-USD, focusing on its current market conditions and future outlook. We will explore key indicators like the Relative Strength Index (RSI), Simple Moving Average (SMA), and Moving Average Convergence Divergence (MACD) to offer a comprehensive BTC-USD price prediction and BTC-USD stock forecast.

Understanding the Current BTC-USD Price

The closing price of BTC-USD at 118602.828125 indicates a dynamic and potentially volatile market. This price point is crucial as it reflects the latest valuation of Bitcoin in US dollars, serving as a benchmark for traders and investors making informed decisions.

Relative Strength Index (RSI)

The RSI, a momentum oscillator that measures the speed and change of price movements, stands at 46.90 for BTC-USD. The RSI scale goes from 0 to 100, where a reading below 30 typically indicates an oversold condition, and above 70 suggests an overbought condition. At 46.90, BTC-USD’s RSI suggests that the currency is neither overbought nor oversold, hovering near the midpoint. This indicates a more balanced market where neither buyers nor sellers are in clear control, suggesting a period of consolidation or potential preparation for a significant price movement.

Simple Moving Average (SMA)

The Simple Moving Average (SMA) is another critical indicator used to determine the average price of BTC-USD over a specific period, in this case, 50 days. The SMA stands at 118642.08, very close to the current closing price. This proximity indicates that the price of Bitcoin is stabilizing around this average, suggesting a lack of strong bullish or bearish momentum. When the price hovers near the SMA, it often indicates a potential turning point or a continuation of the current trend, depending on other market factors.

Moving Average Convergence Divergence (MACD)

The MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. For BTC-USD, the MACD is 87.4666, and the signal line is at 92.5466. The MACD being below the signal line typically suggests a bearish signal, indicating that it might be a good time to sell, as the price could potentially go lower. However, the closeness of these two values could also suggest a weakening of the current bearish trend, possibly leading up to a bullish crossover if upward momentum continues.

BTC-USD Price Prediction and Stock Forecast

Considering the current technical indicators and market conditions, the BTC-USD stock forecast appears cautiously optimistic. The near alignment of the SMA and the current price points to a stable yet vigilant market scenario. The RSI suggests that the market is not overextended in either buying or selling, providing room for potential upward movement if external market factors play favorably.

However, investors should watch the MACD closely for any signs of a bullish crossover, which could indicate an impending upward price trajectory. Given the current data, a conservative approach would be advisable, with a keen eye on global economic indicators that could influence investor sentiment and Bitcoin’s valuation.

Potential Market Movements and Considerations

Investors should consider several external factors that could affect the BTC-USD price, such as changes in regulatory landscapes, shifts in technology, market adoption rates, and broader economic conditions. Additionally, geopolitical tensions or stability can also significantly impact investor confidence and, consequently, Bitcoin prices.

In conclusion, the technical analysis of BTC-USD as of July 25, 2025, shows a market in a state of equilibrium with potential for future movements. While current indicators suggest a stable yet cautious market environment, investors should remain vigilant, considering both technical signals and global economic factors. The close watch of the MACD and RSI, along with external market conditions, will be crucial in making informed investment decisions regarding BTC-USD in the coming days.