Company Overview and Sector Context

NVIDIA Corporation (NASDAQ: NVDA) stands as a titan in the technology sector, focusing on the design and manufacture of graphics processing units (GPUs) for machine learning, gaming, and professional fields. Founded in 1993 and headquartered in Santa Clara, California, NVIDIA has revolutionized the world of visual computing. The company operates primarily in the semiconductor industry, where it faces competition from other giants like AMD and Intel. NVIDIA’s innovative edge is evident through its contributions to artificial intelligence (AI), data center technologies, and its deep learning platforms. With products ranging from GeForce GPUs to enterprise solutions, NVIDIA is pivotal in various high-tech applications. As a leader in GPU design, the company’s impact stretches across various sectors, making it a crucial player in the digital era. Moreover, NVIDIA has leveraged its expertise to dominate the gaming industry and invest heavily in developing AI-driven technologies, driving its competitive edge and market dominance.

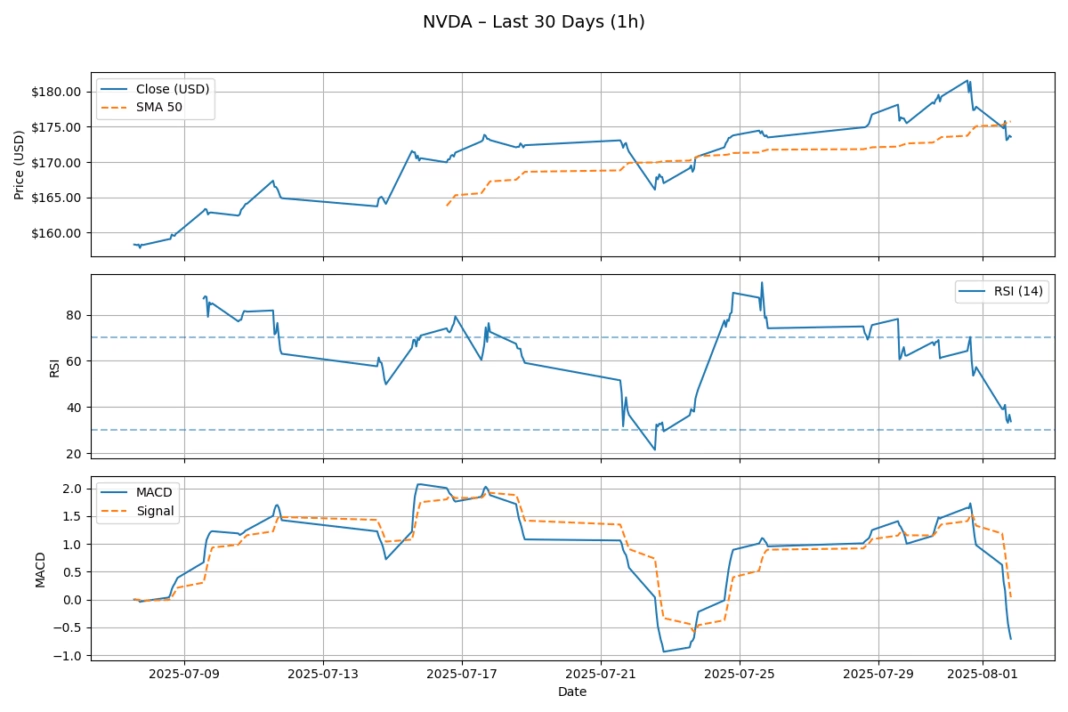

Full Weekly Price Development (technical analysis)

Over the past week, NVIDIA’s stock price began at $174.93 and ended at $173.59, showing a subtle decline. The stock reached a high of $181.57, while the weekly low touched $173.11, indicating a $8.46 range of motion. Despite this fluctuation, the trading volumes remained relatively consistent, underlying a stable market interest. The technical analysis highlights a slight bearish trend with the weekly decline. The RSI of 60.26 suggests the stock is nearing overbought territory, yet not excessively. The MACD, measured at 1.00 with a signal line of 1.10, indicates a negative divergence, suggesting potential bearish momentum as the MACD line continues below the signal line. Overall, these technical indicators suggest caution as the stock may face selling pressure if the bearish momentum continues.

Valuation and Fundamentals

NVIDIA’s valuation metrics reveal a mixed picture of its financial landscape. With a P/E ratio of 56.22, the company is priced for high growth relative to earnings, reflecting its growth potential. Its forward P/E stands at 42.17, signaling anticipated earnings growth. The EPS (earnings per share) over the trailing twelve months is $3.09, while the company boasts a robust market capitalization of $4.24 trillion. A relatively low debt-to-equity ratio of 12.267 indicates prudent financial management. NVIDIA’s impressive gross margin of 70.11% and an operating margin of 49.11% underscore its effective cost management and intricate business model. A return on equity of 115.46% highlights outstanding profitability and shareholder value creation. Additionally, NVIDIA’s revenue stands at $148.51 billion, with a profit margin of 51.69%. A beta of 2.131 underscores higher volatility compared to the market, indicative of greater potential risk and reward. Overall, these fundamentals portray NVIDIA as a financially solid and innovative leader in the technology industry.

Technical Indicators Interpretation

In analyzing NVIDIA’s technical indicators, the RSI, MACD, and signal line provide insights into potential market movements. The RSI, sitting at 60.26, suggests that while the stock is in bullish territory, it is approaching the upper threshold of being overbought. Investors often observe RSI levels above 70 as a signal to reassess buying momentum, thus NVIDIA’s current RSI offers a cue for caution. The MACD, calculated at 1.00, compared to a higher signal line of 1.10, indicates a bearish divergence. Typically, when the MACD line crosses below the signal line, it foretells potential downward pressure. This crossover suggests a bearish sentiment where selling pressure might intensify if short-term capital continues exiting the stock. Moreover, if the MACD line further diverges below the signal line, it could solidify market participants’ bearish sentiment, affecting NVIDIA’s stock price adversely. Notably, these indicators collectively hint at a cautious approach for investors, who should watch for any significant moves or changes in trading volume that might precede a clearer directional trend in the company’s stock price.

Opportunities, Risks & Market Outlook

In contemplating NVIDIA’s prospects, it is crucial to identify both opportunities and risks. NVIDIA is strategically positioned in booming sectors such as AI, gaming, and cloud computing, providing significant growth catalysts. The increasing demand for AI and machine learning solutions amplifies the importance of NVIDIA’s GPU technology, particularly in data centers and autonomous vehicles. Expansions into new markets, evolving tech trends, and strategic partnerships may also offer growth avenues. However, risks include competitive pressures from companies like AMD and Intel, market saturation, and potential regulatory challenges. Macroeconomic factors, such as geopolitical tensions and chip shortages, can impact NVIDIA’s supply chain and market dynamics. As the tech industry evolves, NVIDIA’s ability to innovate and adapt will be crucial. Overall, the outlook is promising, but investors should remain aware of potential volatilities and external influences.

Price Prediction NVDA

Looking ahead to the next two to four weeks, NVIDIA’s stock price could exhibit variability influenced by technical indicators and market dynamics. If bearish pressures persist, the stock could test lows around $170, aligning with the recent downtrend and MACD signal divergences. Conversely, should bullish sentiment regain momentum driven by positive earnings reports or new product releases, a rebound to $180 is plausible. The stock’s oscillation reflects both fundamental strength and technical weaknesses. Investors should watch for market updates, potential adjustments in analyst ratings, or significant sector news which may drive sentiment either positively or negatively.

Final Verdict

NVIDIA represents a compelling case for medium to long-term investors, owing to its robust fundamentals and strategic innovations. Despite recent technical bearishness, the company’s leadership in critical technology sectors underscores its potential for sustained growth. Investors should remain vigilant to shifts in market sentiment and macroeconomic conditions as these could significantly influence short-term price movements. With its focus on AI, gaming, and cloud computing, NVIDIA is set to maintain its industry dominance. As such, patient investors may find current price fluctuations an opportunity to acquire shares in a tech trailblazer. For those keen on navigating the complexities of the tech landscape, staying informed about NVIDIA’s strategic developments will be instrumental in capturing long-term gains.

For more insightful analyses and the latest financial news, subscribe to our newsletter or follow us for regular updates. Stay ahead in the world of investments and technology with our expert insights.