I. Recap: Market Recovery and Underlying Causes

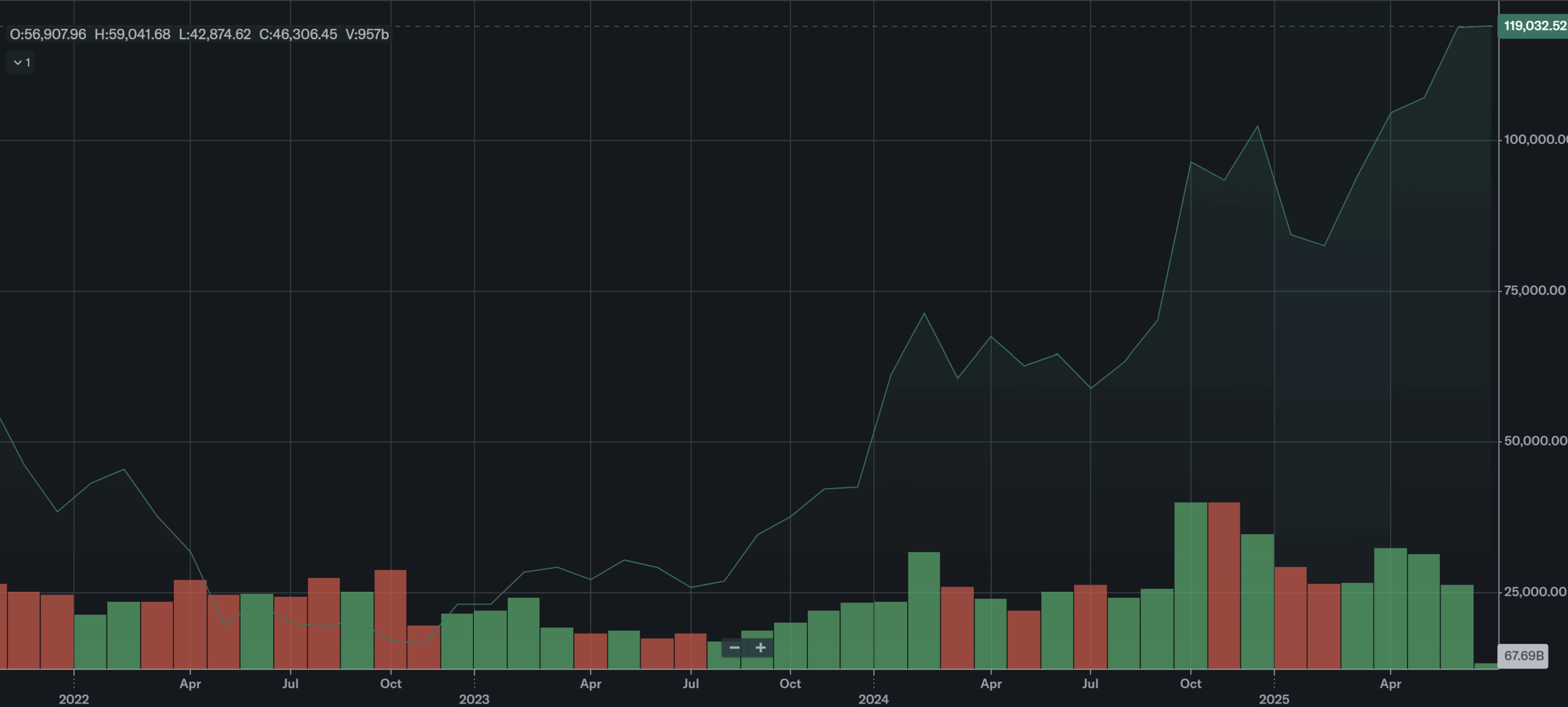

The past several years have seen the cryptocurrency market navigate through extraordinary highs and lows. Bitcoin (BTC) and Ethereum (ETH), the two most prominent digital assets, experienced sharp price fluctuations in response to macroeconomic trends, regulatory developments, and internal network upgrades. After reaching their respective all-time highs in late 2021—$69,000 for Bitcoin and $4,800 for Ethereum—both cryptocurrencies entered a prolonged bear market in 2022. This downturn was triggered by a combination of aggressive interest rate hikes by global central banks, diminishing retail enthusiasm, and heightened macroeconomic uncertainty.

Bitcoin plunged to a cycle low of around $16,000, while Ethereum fell below the $1,000 mark. However, a turning point began to materialize in 2023 and intensified through 2024. As inflation began to ease and central banks paused their tightening cycles, risk appetite returned to financial markets. Cryptocurrencies, being at the frontier of speculative assets, responded positively to these shifts.

By mid-2025, Bitcoin had surged past its previous record to set a new all-time high of roughly $122,000—an increase of more than 668% from its 2023 low. Ethereum followed suit with a strong, albeit less explosive recovery, climbing back above $3,000 and trading at $3,170 by July 2025.

This image shows Bitcoin’s price development since 2022, clearly illustrating the crash and subsequent recovery. The chart is the property of Yahoo Finance.

This recovery was driven by a mix of supply constraints, institutional adoption, and improved blockchain fundamentals. Bitcoin’s halving event in April 2024, which cut the block reward from 6.25 to 3.125 BTC, reinvigorated the scarcity narrative that has historically been a core driver of bull markets. Ethereum benefited from its transition to proof-of-stake via the 2022 Merge and subsequent upgrades like Shapella in 2023, which enabled staking withdrawals and increased the appeal of ETH as a yield-generating asset.

Moreover, Ethereum’s EIP-1559 burn mechanism—activated in 2021—continued to reduce net issuance during times of high network activity, adding to its deflationary potential. Together, these macroeconomic shifts and blockchain-specific catalysts created fertile ground for a broad-based crypto recovery.

II. Current Market Dynamics – July 2025 Snapshot

As of July 2025, the crypto market is showing strength and resilience. Bitcoin recently reached a new all-time high and has since consolidated in the six-figure range, fluctuating between $110,000 and $122,000. Notably, price pullbacks have been shallow and quickly met with institutional buying. For instance, when BTC dipped from $122,000 to $116,000, institutional investors accumulated roughly 11,000 BTC through spot ETFs in just two days. This buy-the-dip mentality reflects strong confidence from sophisticated market participants.

Ethereum, while not yet back at its historical high, has broken key resistance levels. In July, ETH crossed the $2,800–$3,000 zone, a level that had previously acted as a psychological and technical ceiling. The move to $3,170 marked a fresh high for 2025 and was accompanied by rising open interest in futures contracts—now at a record $46.5 billion, a 64% increase since late June.

Beyond price, on-chain metrics underscore the market’s strength. Bitcoin’s MVRV Z-score remains below overheated thresholds, and Ethereum’s staking rate has risen to 29.4%, effectively removing nearly one-third of its supply from circulation. This staked ETH is locked in validator contracts, reducing sell pressure and signaling long-term holder conviction.

Gas fees have also risen due to increased network activity, particularly on Ethereum Layer-2 solutions like Arbitrum and Optimism. This has led to an acceleration in the ETH burn rate, further tightening supply. Analysts interpret these signals as evidence of a healthy and maturing market, where usage and infrastructure improvements are aligning with investor interest.

III. Macro & On-Chain Drivers Supporting Crypto Growth

The broader macroeconomic landscape continues to support the bullish trend in cryptocurrencies. The U.S. Federal Reserve, after an aggressive hiking cycle, has held interest rates steady in the 4.25–4.50% range. Speculation is growing that further rate cuts could arrive later in 2025 if inflation remains near the 2% target. A declining interest rate environment typically benefits alternative assets like crypto, as the opportunity cost of holding non-yielding assets falls.

There’s also political pressure to maintain economic momentum. The current U.S. administration has subtly encouraged the Fed to pursue growth-friendly policies, including a weaker dollar stance. This has created a sweet spot for risk assets. Bitcoin, often referred to as “digital gold,” is increasingly seen as a macro hedge—similar to how investors use commodities during uncertain times.

On the supply side, Bitcoin’s reduced issuance following the 2024 halving has intensified the scarcity dynamic. Post-halving, only ~27,000 BTC are mined per month. In contrast, U.S. spot ETFs alone have absorbed significantly more, creating a supply deficit. Data from Glassnode reveals a net accumulation shortfall of 343,000 BTC, equivalent to over $40 billion at current prices.

Ethereum, too, is benefitting from reduced liquid supply and rising demand. Staking has transformed ETH into a yield-bearing asset, while EIP-1559 continues to burn ETH during periods of network activity. In recent weeks, Ethereum has experienced several days of net-negative issuance, raising the possibility of ETH becoming deflationary on a yearly basis.

Institutional capital is entering ETH through multiple channels. In addition to trusts and ETPs, major asset managers are pushing for a spot Ethereum ETF approval, potentially as early as August. If approved, ETH could mirror BTC’s explosive gains following its ETF launch.

IV. August 2025 Forecast: Price Scenarios and Strategic Insights

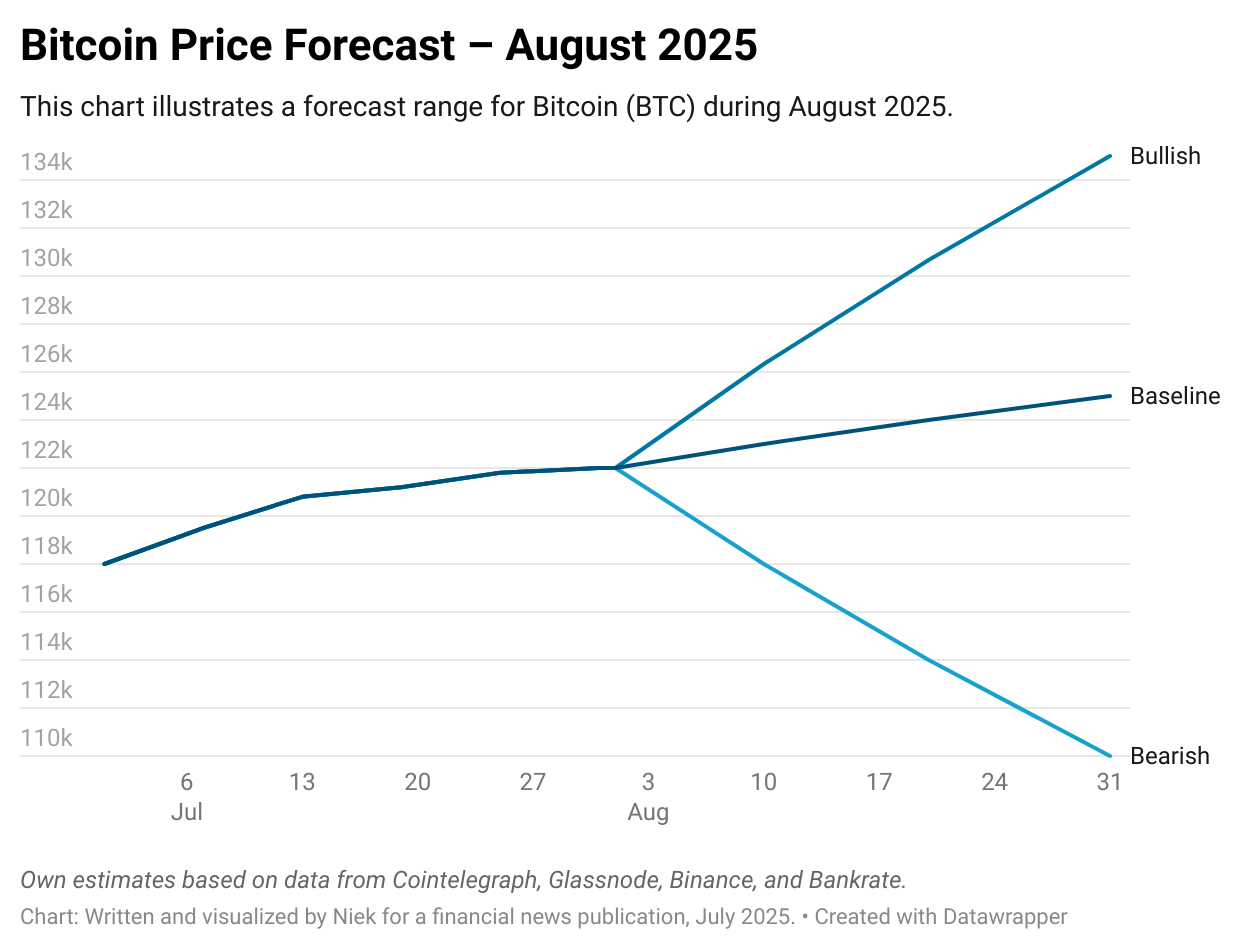

Bitcoin (BTC)

- Baseline Forecast: BTC is likely to trade in a broad range between $120,000 and $130,000 throughout August. This consolidation phase could serve as a foundation for a future breakout.

- Bullish Case: If ETF inflows remain robust and macro conditions stay favorable, BTC could test $135,000 by late August.

- Bearish Risk: A surprise macro event (e.g., inflation spike, hawkish Fed rhetoric) could trigger a correction to the $110K–$115K support zone.

- Investor Insight: Traders should monitor ETF inflows and on-chain activity. If accumulation trends hold, any pullback may present a buying opportunity rather than a trend reversal.

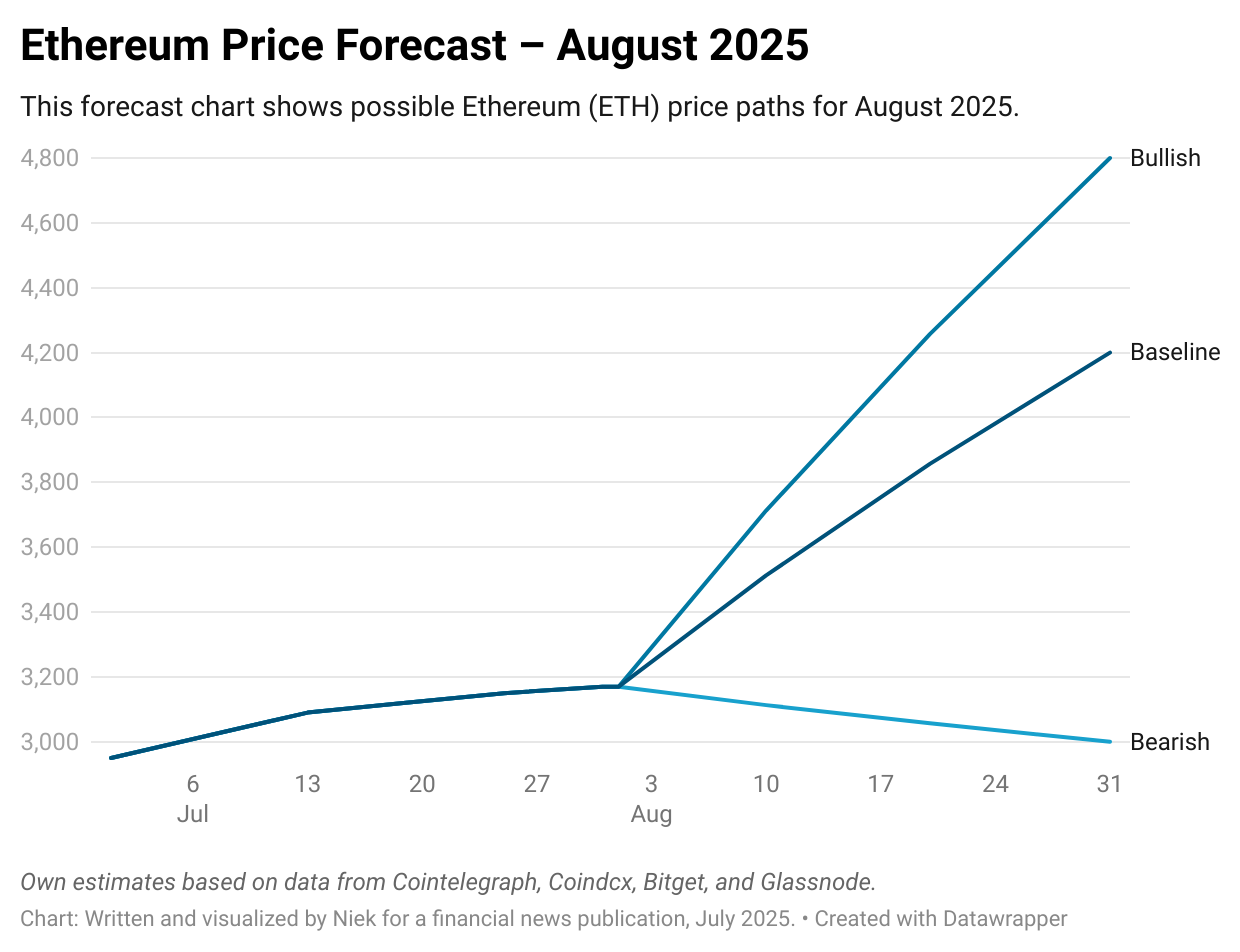

Ethereum (ETH)

- Baseline Forecast: ETH is expected to climb toward the $4,000–$4,200 zone in August. A breakout above $4,200 would open the door to retesting the 2021 high of ~$4,800.

- Key Catalysts: Potential approval of a spot ETH ETF, continued growth in Layer-2 activity, and rising staking rates.

- Resistance Levels: Strong resistance is anticipated near $4,300–$4,400. This area has historically triggered profit-taking.

- Risk Factors: If Bitcoin falters, ETH could struggle to maintain its upward trajectory. Similarly, if gas fees spike too sharply, network usage could temporarily decline.

V. Editorial Take: Opportunity Meets Discipline

From a strategic standpoint, the current setup in crypto offers significant opportunity—but also requires discipline. Bitcoin is becoming a recognized store of value with institutional backing. Ethereum, meanwhile, is the infrastructure backbone of Web3 and decentralized finance. Together, they offer complementary exposure to different use cases in the blockchain economy.

Still, investors must remain vigilant. The market’s historical volatility should not be ignored. Sudden regulatory announcements, technical issues, or macroeconomic surprises can swiftly change sentiment. The strong foundations in 2025 do not guarantee uninterrupted growth.

The prudent approach is to stay data-driven. Monitor support and resistance zones, track ETF flows, and understand on-chain dynamics. For long-term holders, dollar-cost averaging remains a sensible strategy. For active traders, watching the $130K and $4,200 levels as breakout points can guide short-term positioning.

In summary, the outlook for August 2025 is broadly bullish. Both Bitcoin and Ethereum have strong momentum, driven by macroeconomic alignment and fundamental strength. Yet, the path upward will likely involve volatility, making it essential for investors to combine optimism with risk management.

Sources (listed once each for clarity):